The original headline to this story said Tyler Rock started this app. He is actually only a representative. Elon News Network regrets the error.

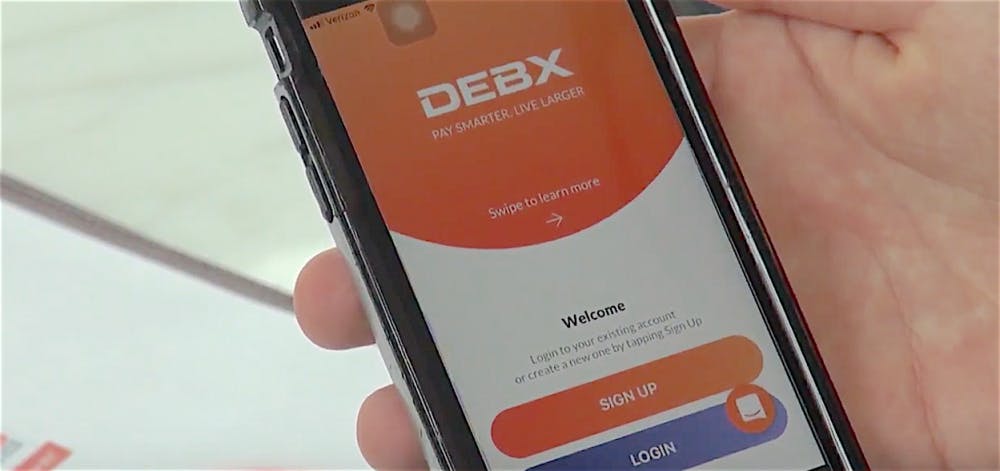

On March 21, 2018, a man named Ben Psillas launched an app with the potential to change the way people manage money.

Psillas and his team are the co-founders of Debx, an app that helps consumers get the most out of their credit cards by creating financial security. It helps people to earn credit and credit card rewards without the risk of going into debt.

Debx does all this by letting users link their accounts to the app and set spending limits for themselves. While users spend normally, Debx uses the money in their checking accounts to pay off their credit card balances, helping them stay out of debt and make the most of their credit cards.

The company itself is a pre-revenue organization that will eventually advertise other financial products to app users to pay the bills. The app is free for everyone right now, and Debx has taken a special interest in marketing its app to

college students.

Because many college students struggle with money — from paying for parking tickets, to student loans, to meal plans — Debx has hired a campus representative to help students at Elon University get their finances under control.

Senior Tyler Rock is a finance and marketing double major at Elon who was chosen to be the representative because of his access to a college student market and his ability to relate to college students.

“I think it’s a really exciting idea and something everyone can benefit from ... just helping people realize that tools like that are available,” Rock said.

And he has a personal connection that makes him passionate about sharing the app.

“I’ve seen some friends of mine who have run up some debt over their monthly bill, and they don’t really realize what is going on until it’s too late,” Rock said.

But one thing Debx downloaders might worry about is if the app really protects their banking security. The security software that Debx uses is what the company calls ‘bank grade security.’ This means the Debx company will never see any checking account information and it will never touch the funds in a user’s account. It also encrypts all financial information to prevent unauthorized access to user information.

“It’s just so simple and just genius,” Rock said. “I feel like it should have been invented before.”

But what Rock said he is most hopeful about is that his peers will learn to be more financially responsible because of this app.

“I feel like great tools like this are very important for them because it can be a little scary … it helps students learn the basics of it and how they can be financially responsible,” Rock said.

But Kate Upton, assistant professor of finance, believes it is more important to learn financial responsibility in a controlled environment like a classroom.

“There is really, especially in this industry, no substitute for having an individual teach you versus an app,” Upton said.

Upton believes this because the financial needs of all college students vary. She says there are two sides of the spectrum: those lower income students who are paying their own way through college and those higher income students who are paying for college with a support system like their parents to help them. And while both groups can benefit from financial planning and spending, the lower income students are more in danger of what Debx is trying to fix — debt and bad credit.

“Those are the students where most of the predatory lending takes place, and that would be through over offering student loans, and in this case, we are not talking about government student loans but more about the high rate subsidies student loans,” Upton said. “If I was to think of an app like this, they would be most likely to benefit.”

But while college students struggle with credit cards and debt, Upton says college students are not the population that struggle with them the most: it’s lower income people outside

of college.

“People are actually spending monthly payments on their credit cards, and we are actually seeing that lower income populations that aren’t college students are the ones to spend that money on monthly expenses,” Upton said.

What happens if one pays their monthly bills, like cable or utilities, with a credit card is that their expenses wrack up to the point where such individuals cannot pay off their credit card bills and then go into debt as a result.

“One thing that is important for college students to remember is that sometimes no credit is worse than bad credit,” Upton said. “So, in other words, if you don’t ever purchase things on credit or have credit cards, how do things get proved to lenders that you are creditworthy?”

But bad credit should not deter a college student from opening a credit card. Upton just warns that they need to be careful.

“It’s important if they feel like they are financially capable and have the personal willpower to open a credit card, to spend mildly on it each month and pay it off each month,” Upton said.

This is where Upton still believes an app like Debx could be useful for college students. But even with an app available to guide students along, she has concerns about the security of the app.

“My question would be: what are they charging you, or where are their expenses coming from?” Upton said. “I would want to know more if I was a consumer about what is their model? Are they just generating an app like this out of the goodness of their hearts, or are they somehow mining or selling my data?”

But Senior Clay Bruning, who has been using the app, is not worried.

“I think that Debx places their customers’ privacy at the forefront of their business and will do any and everything to protect our data,” Bruning said.

While Debx claims they have no intentions on mining the data of its customers, they will use other user data to market other financial products to their consumers through the app. But despite their assurances of security, Upton still believes being responsible for your own financials is the best way to handle your own money and banking needs.

“Financial literacy is certainly important and something we need to talk about as part of a well-rounded college education,” Upton said.

Despite this, Bruning says the app is easy to understand and has helped him keep control of his finances.

“I love that the app makes it easy and routine to make my credit card payments, which in turn helps constantly build up my credit. This app is helping secure my future by aiding me to an outstanding credit score,” Bruning said.

Bruning said he is personally excited to see how the app grows from here.

“I think the app has potential to expand,” Bruning said. “They could expand to capabilities like that of Venmo and Zelle to make transfer payments to your bank or cards to other people at an expedient pace like they do for their credit card payments.”

Debx hopes to be able to expand and offer consumers more suggestions on how to keep a little more money in their wallets.