Debate fueled by the presidential race continues to rage concerning President Barack Obama's recent executive order, which intends to relieve some of the financial burden college students face with loans after graduation.

The executive order decreases the minimum payment on student loans from 15 to 10 percent. The order also lowers the number of years after graduation at which student loans are forgiven from 25 to 20.

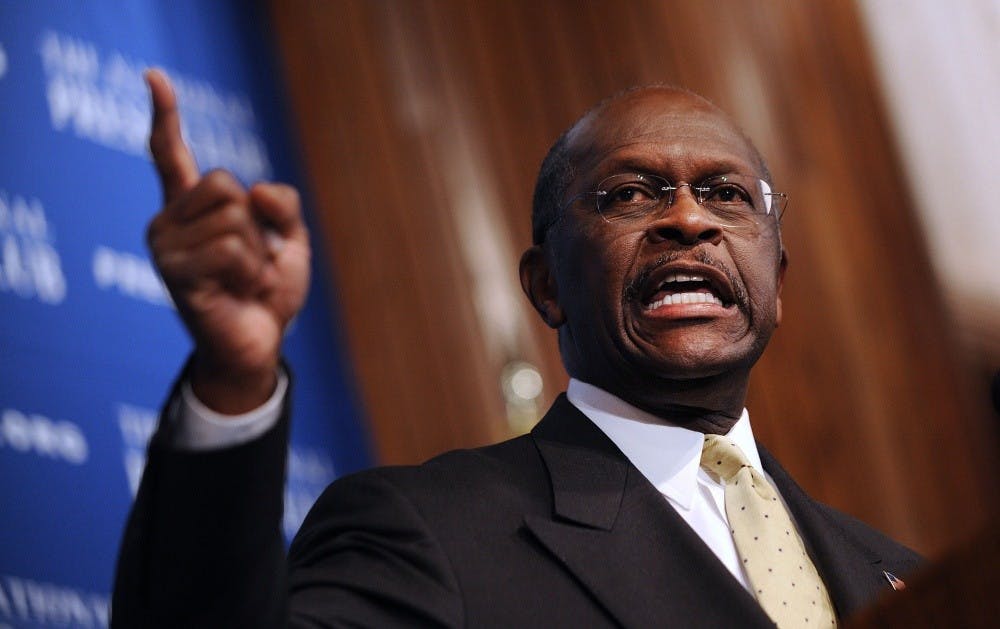

Some Republican presidential candidates, like businessman Herman Cain and Rep. Ron Paul, have said on the campaign trail they do not believe the federal government has a responsibility to support higher education. But the issue has not been a priority for all candidates.

Neither former Mass. Gov. Mitt Romney nor Texas Gov. Rick Perry has education platforms posted on their campaign websites. Perry recently took heat from conservatives for allowing illegal immigrants to pay in-state tuition and Cain, who is currently leading in many Republican polls, has said he believes those who really want a college education can reach it without the aid of the federal government. Rep. Michele Bachmann has said the president's changes are a "moral hazard."

The impact of Pell grants on federal debt is dwarfed by entitlements and defense spending. Out of an estimated $3.8 trillion budget this year, only about $40 billion is invested in Pell grants — roughly 1 percent.

"Student loan debt, on some level, is actually a good thing," said Steven Bednar, assistant professor of economics at Elon. "The more highly educated workforce you have, the more the economy can grow. We like to think that students develop specific skills and knowledge while in college that will be applied to the workforce, get them better jobs, and grow the economy."

In the 2010-2011 academic year, Elon students received more than $2.5 million in Pell grants, which do not have to be repaid, and close to $3 million in work study funds from the federal government. Most other forms of financial aid are distributed by the university itself.

Senior Jay Light said he believes the government has a fiscal responsibility to prospective students.

"Since there are a lot of people our age in this country who unfortunately can't afford college any other way, the government does have a little bit of an obligation to help them out," he said. Junior Ronda Ataalla agreed.

"I definitely think the government should support financial aid, because all our future is in school right now," she said.

Many student loans are income-based, which means after graduation, payments are capped at a percentage of the borrower's discretionary income. Graduates with no income pay nothing.

This is different than a mortgage, where the payments are a fixed amount.

Bednar said he does not see anything in Obama's proposed changes students could use to cheat the system.

"It's supposed to give temporary relief to people that need it," he said. "I don't see people taking out extra student loans to live it up in a much nicer house while in college and only eat caviar. I don't think behavior will change because of this."

Patrick Murphy, director of financial planning, said he does not support the Republican argument.

"I don't think it is wise to cut this funding because it's mostly other areas in the budget that are the problem," he said. "With education, there are ramifications down the road and people can't wrap their brains around it."

Regardless of the burden, Bednar said he still believes a college degree is worth the risk in a stagnant job market.

"It's harder to see the value of a college education when you graduate during a down economy and don't find a job right away," he said. "But it is important to think about the long term and know that your lifetime earnings will most likely be much higher because you have the degree"