Now a household name, Facebook has transfixed and inspired a generation, as well as given the social media world a major renovation. Facebook is about to jump from the screen of our computers, smartphones or tablets to Wall Street. Facebook is going IPO soon and the world is abuzz talking about it.

So, what is an IPO, exactly? IPO stands for Initial Public Offering. It’s the first public sale of a private company. Many people are saying that an IPO is exactly what Facebook wants, but it’s actually the complete opposite. Facebook is being forced to turn into a public company because of its size. In America, companies must go public once they reach above 500 shareholders.

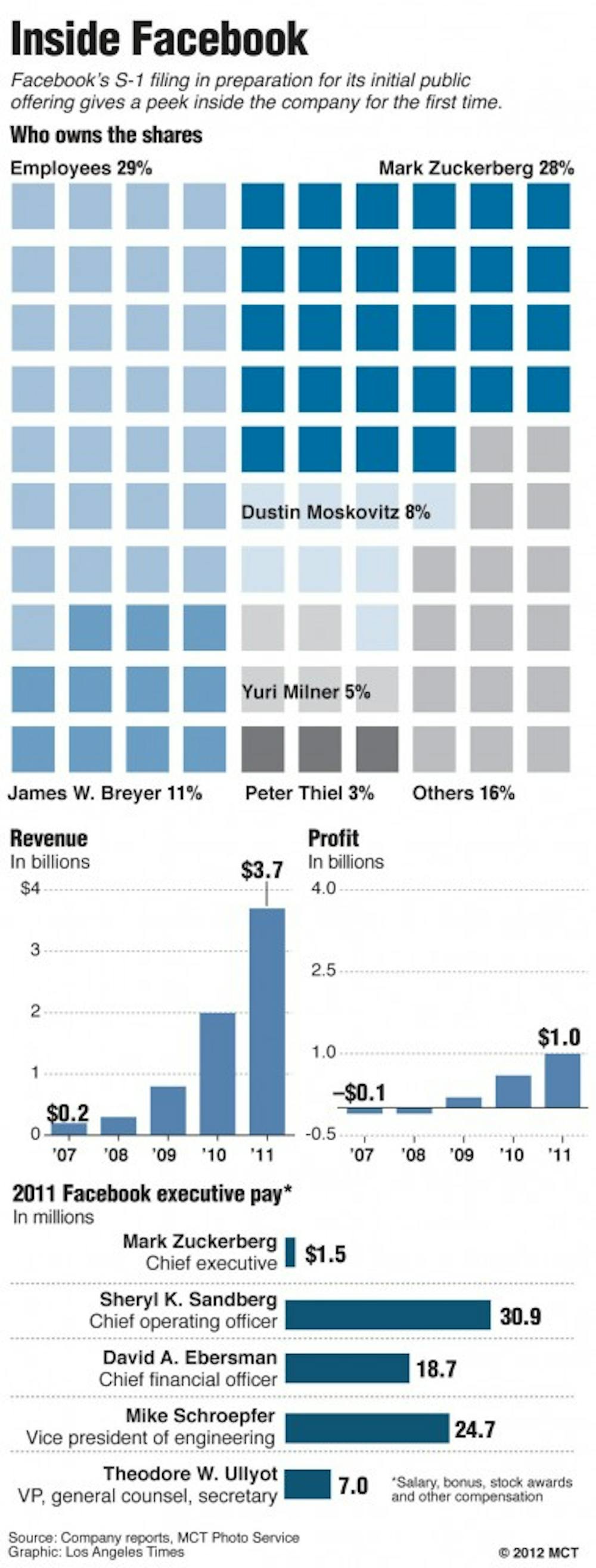

Startup companies are normally attracted to going public because doing well in the stock market would lead to a major cash flow for the company. Facebook, on the other hand, isn’t a small startup anymore, and they hardly need the cash, even though it's been estimated that Facebook could get $5 billion by being on the stock exchange.

Facebook’s CEO Mark Zuckerberg has been delaying Facebook’s transformation to public company. He’s even gone to Congress lobbying for a bill that would allow companies to stay private until their shareholder number reached 2,000.

So, why is Zuckerberg so shy to get that company stock symbol? The CEO hasn’t talked much to the public about his thoughts or ideas, but I think the cold feet to go public is for an obvious reason. Zuckerberg has been the boss of Facebook since its creation. But once Facebook goes public, there will be a new boss in town: shareholders. These won’t be your average Joe shareholders, either. I severely doubt that everyday people will be able to afford stock in Facebook, or at least enough stock to really have a say. Also, Facebook is selling very little stock of its company, so its very likely there won’t be enough to go around.

Facebook’s primary concern should be convincing big companies buying it out, whose shareholders will demand Facebook exist as a for-profit company. Also, Facebook can no longer be such an opaque company. Now that it will be public, we will know exactly how much the company makes and how they make it. We will also know any legal proceedings against them, what kind of risks they have and we will get some sort of idea on where the company will be headed for the future. My personal favorite is that we will also learn how much those executives bring home.

When Facebook hits the market sometime in May, it will certainly be an interesting day for the stock market, but probably won't affect the day-to-day Facebook users yet.