The U.S. Supreme Court upheld the Patient Protection and Affordable Care Act in a 5-4 ruling Thursday, legally affirming the constitutionality of the healthcare reform originally passed by Congress in 2010. The law, a key component of President Barack Obama’s platform, will take full effect in 2014.

The most controversial provision of the Affordable Care Act is the individual mandate, which requires all Americans to purchase at least a baseline health insurance policy, or provide a “shared responsibility payment” to the IRS.

“I think over time (the mandate) will ultimately improve the health of all Americans,” said Ginette Archinal, a family practitioner at Cornerstone Medical Center in Burlington. “If you can provide better healthcare to Americans across the board, including those currently without coverage, you will improve the health of Americans as a whole.”

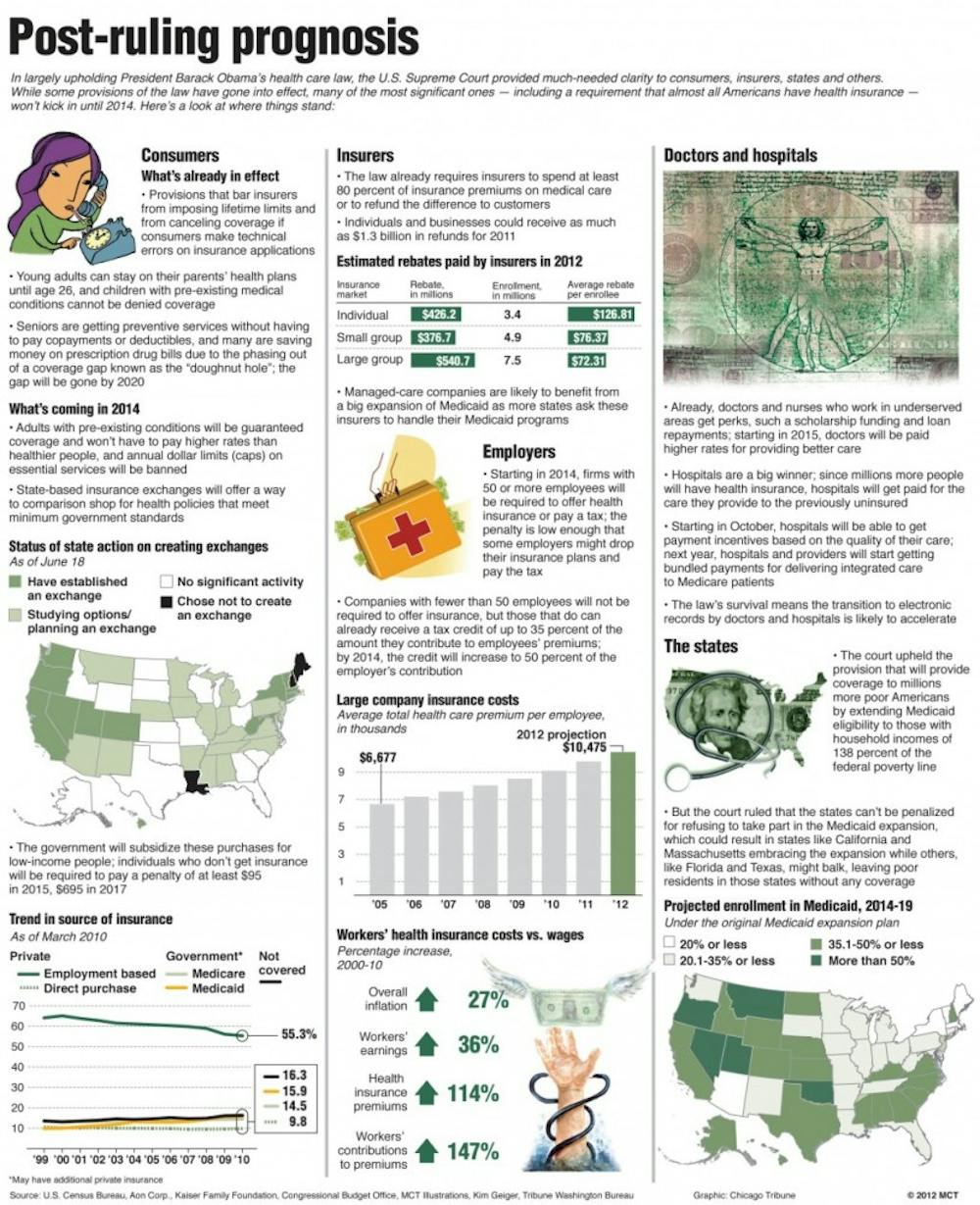

Other provisions of the law were upheld, as well. The court ruled dependents younger than 26 may be insured under their parents’ policies, a decision that may benefit college students and recent graduates.

“Unfortunately, given the current economic climate and people graduating without jobs, students are going to be able to know that, assuming their families have healthcare, they will be covered into their mid-twenties,” Archinal said. “From a practical point of view, it would have been pretty bad for students if that part (of the law) had been thrown out.”

And health insurances companies can no longer deny coverage to those with preexisting conditions, a provision Archinal considers very important.

“Nobody is going to be penalized for having a preexisting condition,” she said. “Maintenance medications (for such conditions) are extremely expensive, even with insurance. Many people benefit from this.”

The government argued the individual mandate was constitutional under the Commerce Clause, which affords Congress the right to regulate commerce. The Supreme Court, however, deemed the argument invalid, instead interpreting the mandate as constitutional as a tax on uninsured citizens.

"In making its Commerce Clause argument, the government defended the mandate as a regulation requiring individuals to purchase health insurance,” Chief Justice John Roberts wrote in the court briefing. “The government does not claim that the taxing power allows Congress to issue such a command. Instead, the government asks us to read the mandate…as imposing a tax on those who do not buy that product.”

Individuals who don’t maintain minimum essential coverage will face a penalty, first enforced in 2014. It will begin at $285 per family, or one percent of household income, depending on which amount is higher. By 2016, the penalty will cost $2,085 per family, or 2.5 percent of household income.

Regardless of its legal definition, some consider the mandate a positive incentive.

But Archinal was quick to acknowledge the ultimate success of the mandate is contingent on other factors.

“The law hinges on there being enough primary care providers,” she said. “Depending on where you live, there is already a shortage.”

But the constitutionality of the individual mandate was not the only issue on the courtroom floor. The Affordable Care Act also calls for an expansion of Medicaid eligibility and threatens to cut Medicaid funding from states that don’t expand their coverage. The Supreme Court upheld the call for expansion, but ruled the federal government cannot cut funding to state governments that choose not to participate in the new program.